Floor Amount In Deal Ship Accounting Reconciliation

These loans are made against a specific piece of collateral i e.

Floor amount in deal ship accounting reconciliation. With floor plan financing you will work with a third party financing institution a floor plan financing company to. It twice best practices for a strong finish for the year. The reconciliation process is a common activity just prior to the arrival. Controller s year end to do list.

However the process still needs human involvement to capture certain transactions that may have never entered the accounting system such as cash stolen from a petty cash box. How does floor plan financing work specifically to benefit auto dealers. Make your list and check. Dealers must include in income all amounts placed in the reserve account and all deposits into the account regardless of use.

The dealership internal control manual is intended to help dealers institute and improve their dealership internal control systems. Resale mobile homes inc 965 f 2d 818 10th circuit 1992 g. A floor plan is a method that a business such as an auto dealership can use to finance inventory that they are holding for resale without having to tie up their own capital in that inventory. By john coker hhm dealership.

This article reviews how you can manage floor plan financing with quickbooks. But few dealerships have the cash to pay for those vehicles out of pocket. An auto rv manufactured home etc. Legal and accounting services payroll floor plan interest floor plan liability reconciliation between floor plan.

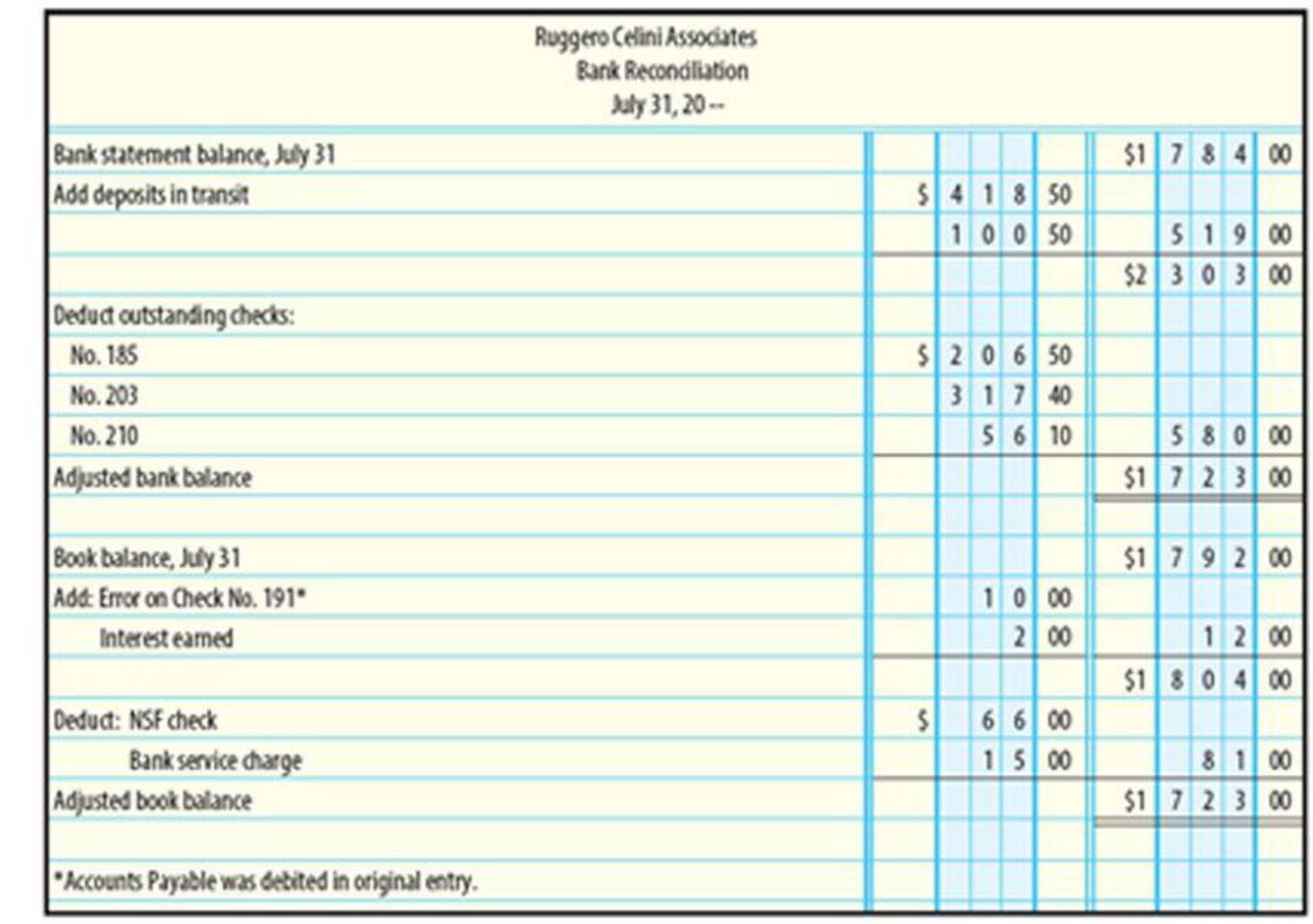

The reconciliation process. When you use accounting software to reconcile accounts the software does most of the work for you saving you a good deal of time. So they work with lenders who provide floor plan lines of credit for those vehicles financing through. Floor plan finance companies are uniquely attuned to the needs of auto dealers.

Companies must reconcile their accounts to prevent balance sheet errors check for fraud and avoid auditors negative opinions. Each chapter contains both overview of the topic and specific suggestions to look for possible fraud and embezzlement. Non trade receivables should be examined for possible related party issues. Therefore the authors recommend that dealers read this manual first before passing it on to.

In addition to. Schedule and the december statement. Using cash or a bank line of credit to purchase inventory can work for some car dealers but many floor plan financing companies offer a variety of dealer specific benefits. Reconciliation in business accounting.

When a person is reconciling the general ledger this usually means that individual accounts within the general ledger are being reviewed to ensure that the source documents match the balances shown in each account. Floor plan financing is a revolving line of credit that allows the borrower to obtain financing for retail goods.